Notes

NOTES

Stocks performed well in the second quarter of 2023. After the S&P 500 scored modest gains in April and May, the index soared 6.61% in June – goosed largely by exuberance over Artificial Intelligence. Time will tell whether that exuberance is rational or not.

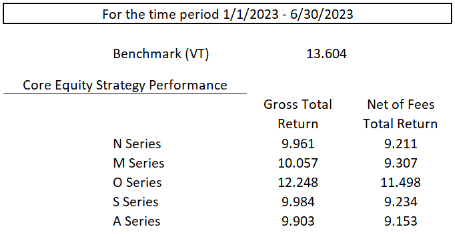

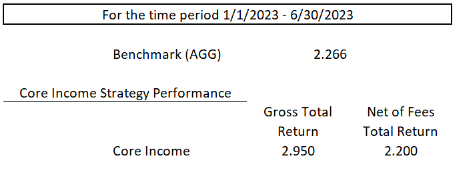

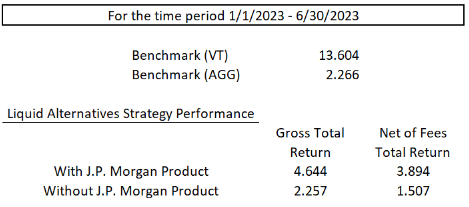

Our models generated positive returns. 1 We underperformed the equity benchmarks due to our defensive posture, but were positive. 2 We outperformed the bond indexes. 3 Alternatives underperformed stocks and were even to better than bonds depending on the model – as we would expect in this market environment. 4

Looking at the data, CPI continued to moderate, but still remains elevated at 4.8% ex food and energy. Services ex energy makes up 58.3% of the CPI and by itself rose 6.2% in June. A large component of services ex energy is shelter.

The shelter index increased 0.4 percent over the month after rising 0.6 percent in May. The index for rent rose 0.5 percent in June, and the index for owners' equivalent rent increased 0.4 percent over the month. The index for lodging away from home decreased 2.0 percent in June after increasing 1.8 percent in May. The shelter index was the largest factor in the monthly increase in the index for all items less food and energy.

Housing inventory remains tight. 0.4 percent is 4.8% annualized. The shelter index is up 7.8% YOY.

Among the other indexes that rose in June was the index for motor vehicle insurance, which increased 1.7 percent, and the index for apparel which increased 0.3 percent. The indexes for recreation and personal care also increased in June.

Wages rose 5.7% YOY, further evidencing the resilience of the economy.

All of these data points indicate to us that the consumer in the US is still quite healthy. Retail sales bore that out by advancing for the third month in a row. Economists estimate that the personal consumption of goods and services accounts for roughly 2/3rds of US economic activity.

The US economy has slowed since the peak recovery 2 years ago, but no longer appears to be contracting. While this may indeed be what a “soft landing” looks like – “soft landing” means continued economic growth with inflation under control, it may turn out rather to be a staging area for a resumption of further monetary tightening.

While inflation has moderated, it remains elevated well above the Federal Reserve’s 2% target. One year ago, the federal funds rate stood at 1.25%. Today it stands a bit above 5%. The Federal Reserve began shrinking its balance sheet in June 2022: no one can predict the outcome here. There has never been an episode of Quantitative Tightening of this magnitude for this expected duration. All of which increases the probability of a policy mistake.

The effects of the “long and variable lag” between monetary policy and the real economy should begin to show up more clearly likely in the last quarter of 2023, about when the 2024 race for the White House begins in earnest. Historically, the Federal Reserve has tempered policy so as not to influence the outcome of the election. Except for the Volker Fed that held rates above 12% from October 1979 to November 1980, pushing the economy into recession, thus opening the door to Ronald Reagan’s famous question in the one and only debate the week before the election, “Are you better off now than you were four years ago?” Reagan routed incumbent Jimmy Carter.

Speaking of elections, the new Congress is scheduled to be seated on January 3, 2025. But there’s this thing called the “debt ceiling” which is suspended until January 1, 2025. That means a lame duck session must deal with that contentious issue, after what is likely to be yet another contentious election. The new Treasury Secretary will be handed the reins hopefully in time to execute the extraordinary measures taken by the current Secretary to hold off the fiscal Doomsday in this current year.

We expected this summer to give us more clues about where we may be headed. What we observe is a consumer and a domestic economy that remains resilient. Inflation, while trending thankfully lower, remains persistently well above the Federal Reserve target of 2%. Wages are for now keeping up with and currently outpacing inflation. Unfortunately, that series of data points resembles a wage/price spiral -- not a soft landing. And increases the probability of higher rates still for much longer.

That long and variable lag could produce an inflection point later in 2023. For now, we watch and we wait, holding our positions steady, and our hands calmly at rest.

2.

3.

4.

This communication should not be regarded as an offer or solicitation to buy or sell any securities or investment products, an official confirmation of any transaction, an official statement, or as any other official statement of Forge Consulting, LLC or its affiliates, which include but are not limited to Advocacy Trust LLC, Advocacy Inc., Advocacy Wealth Management, Forge Capital, LLC, Forge Capital Services, LLC, and Full Circle Coverage (altogether referred to as “Forge”). Forge does not provide tax, accounting, or legal advice to its clients, and all clients are advised to consult with professionals who can provide tax, accounting, and legal advice regarding any potential investment.

Securities and insurance products are NOT

insured by the FDIC, nor by any other Federal or state government agency, are NOT

a deposit of and are NOT

Guaranteed by a bank or any bank affiliate, and MAY

lose value.

FORGE and

are registered trademarks of Forge Consulting LLC.

is a registered trademark of Advocacy Wealth Management, LLC.

, FORGE CAPITAL, FORGE FOR BUSINESS, FULL CIRCLE, and ABACUS ADVISORS are trademarks of Forge Consulting LLC.

All investments involve risks that you will lose value including the amount of your initial investment. Investments that offer the potential for higher rates of return generally involve greater risk of loss. Note: reinvestment transactions that involve selling existing investments may involve transaction costs associated with the sale of those assets as well as transaction costs associated with the purchase of new investments.

International investing: There are special risks associated with international investing, such as political changes and currency fluctuations. These risks are heightened in emerging markets.

Small/Mid-Capitalization investing: Investments in companies with small or mid-market capitalization ("small/mid-caps") may be subject to special risks given their characteristic narrow markets, limited financial resources, and less liquid stocks, all of which may cause price volatility.

High-Yield investing: Investments in high yielding debt securities are generally subject to greater market fluctuations and risk of loss of income and principal, than are investments in lower yielding debt securities.

Inflation Protected Bond investing: Interest rate increases can cause the price of a debt security to decrease. Increases in real interest rates can cause the price of inflation‐protected debt securities to decrease. Interest payments on inflation‐protected debt securities can be unpredictable.

Interest Rate Risk: This risk refers to the risk that bond prices decline as interest rates rise. Interest rates and bond prices tend to move in opposite directions. Long‐term bonds tend to be more sensitive to interest rate changes and therefore may be more volatile.

Copyright ©2024 The Forge Companies. All Rights Reserved.