INSIGHTS

August 2025

Let's Make a Deal!

Nature's Symphony

Breathtaking colors of our planet

Button

AI-generated illustration created with OpenAI’s DALL·E.

Game shows popped onto the air shortly after the dawn of television, well before the sitcom. The first was Spelling Bee (1938), in which contestants tried to outspell celebrity guests. The game show format has many variations. Particularly popular during the original “Golden Age of TV” from 1947 to 1960 were daytime variations of everyman competing against everyman for a prize. This spectacle traces directly forward to some of the “reality shows” available today, and, more darkly, backwards to the Coliseum in ancient Rome.

In Monty Hall’s era of Let’s Make a Deal, the audience competed against each other to be chosen to take cash, which Monty would wave in front of the chosen contestant, or pick “Door #1, Door #2, or Door #3”. Behind two of the doors there is a goat, while behind one of the doors there is a car. Choose a door and Monty would have one of the other two doors opened to reveal a goat. Should you choose to stick to the first door or should you switch? From there came a series of other choices: keep the door or trade it for the box… and so on.

So… should you take the cash like the UK? Should you take Door #1 like Japan? Or did you choose Door #2 with the goat like Vietnam? Or did Monty not even pick you to play like India?

We could go on, but we will leave it there as just a reminder that the uncertainty over tariffs will continue, so long as Fox News deems it worthy of broadcast.

Portfolio Updates

In a recent meeting of our Investment Policy Group, led by our Chief Investment Officer, Scott Thompson, a couple of slides in particular illuminate the reasoning behind some recent changes to one of our models.

In our tactical model S, we exited the overweighting to Consumer Discretionary (FDIS), which initially gained ground immediately after the election last November, but has steadily given it all back to tariff uncertainty.

We also sold an ETF (FSMD) that held U.S. Small and Mid Cap stocks. This holding, purchased in mid-March, performed quite well over the period. Its purchase had pulled the model closer to its benchmark; its sale is tactical and defensive. Slowing consumption and continued tariff uncertainty make this area of the domestic stock market particularly vulnerable, in our opinion.

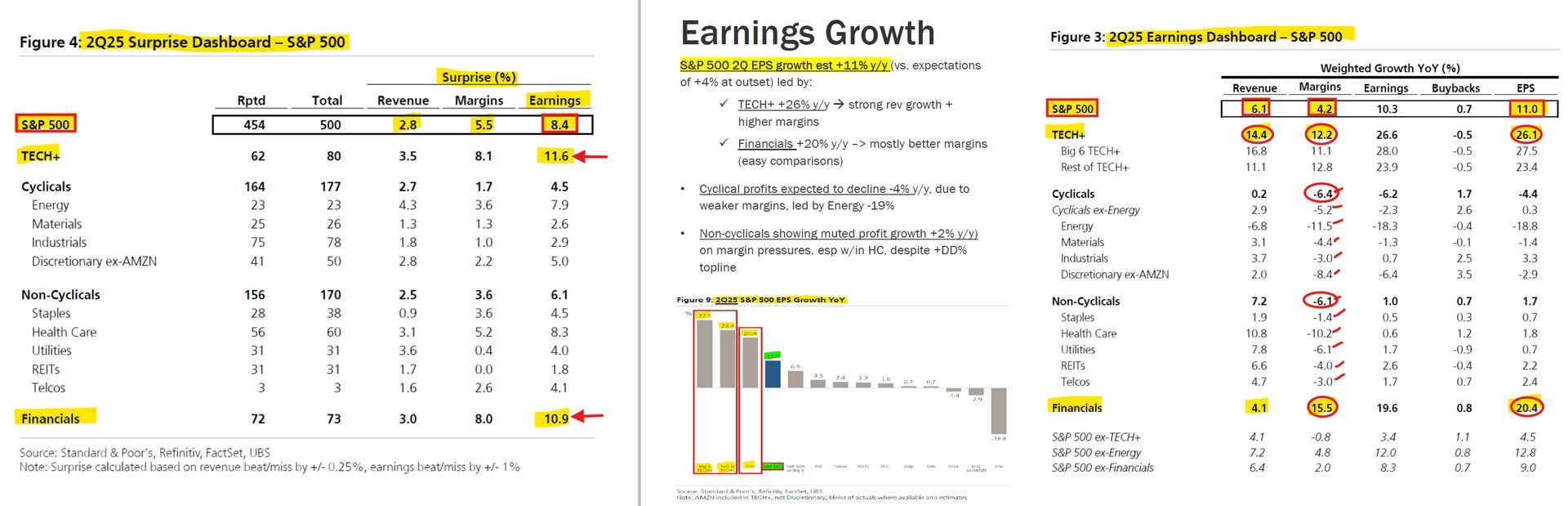

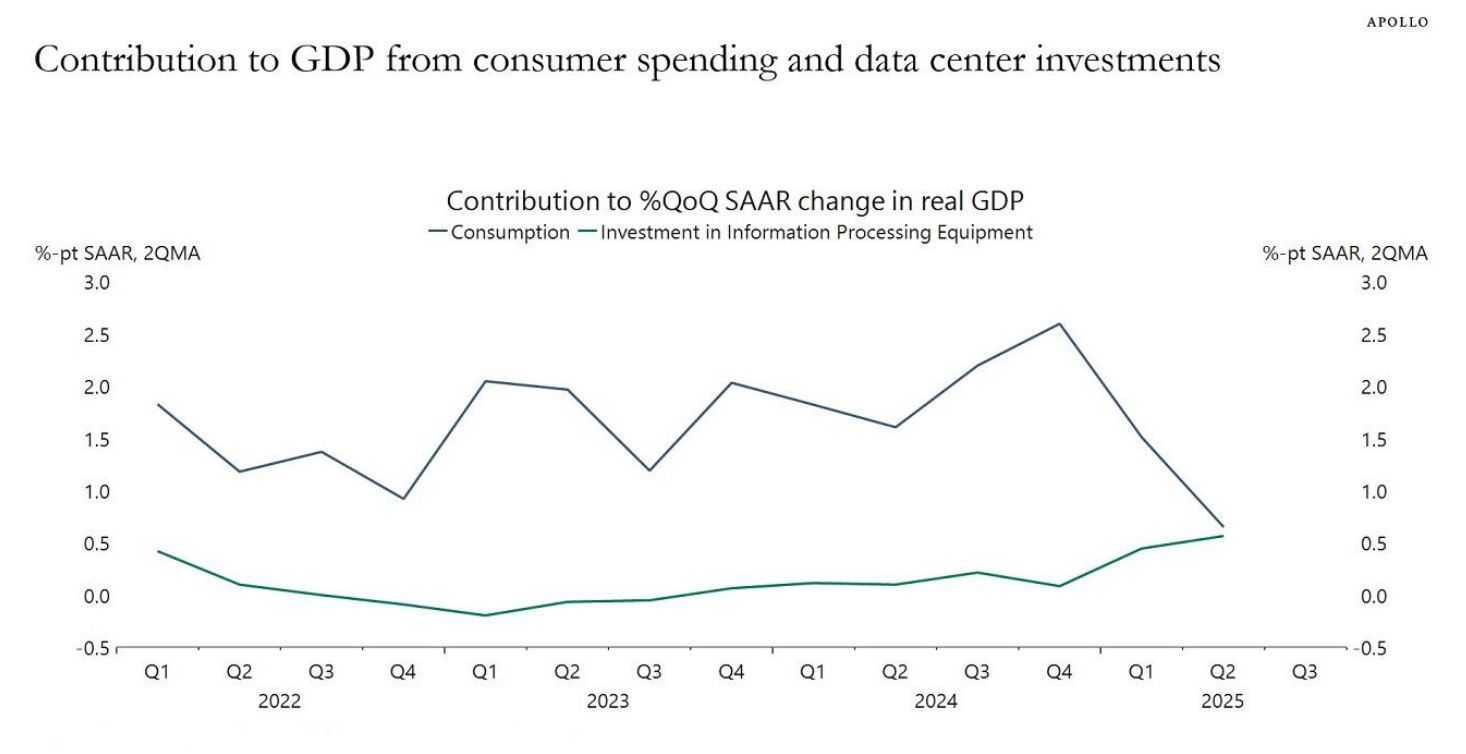

With those proceeds we bought two ETFs targeting exposure to Artificial Intelligence within the tactical model. (The other equity models already have an overweighting there.) The numbers on the slides above tell only part of the story: that sector and investment into it is driving both revenues and margin expansion at much higher growth rates than all the others.

“Artificial intelligence holds great promise for expanding access to expert medical knowledge and reasoning. However, most evaluations of language models rely on static vignettes and multiple-choice questions that fail to reflect the complexity and nuance of evidence-based medicine in real-world settings. In clinical practice, physicians iteratively formulate and revise diagnostic hypotheses, adapting each subsequent question and test to what they’ve just learned, and weigh the evolving evidence before committing to a final diagnosis. To emulate this iterative process, we introduce the Sequential Diagnosis Benchmark, which transforms 304 diagnostically challenging New England Journal of Medicine clinicopathological conference (NEJM-CPC) cases into stepwise diagnostic encounters. A physician or AI begins with a short case abstract and must iteratively request additional details from a gatekeeper model that reveals findings only when explicitly queried.” 1

We read about this example a few weeks ago in the Financial Times. That article explained that what Microsoft has done is to use their own AI “orchestrator” to query the “gatekeeper”. Gatekeeper then passes the query along to… “leading large language models [‘LLMs’] from OpenAI, Meta, Anthropic, Google, xAI and DeepSeek. The orchestrator made all LLMs perform better but worked best with OpenAI’s o3 reasoning model to correctly solve 85.5 per cent of the NEJM cases. That compared with about 20 per cent by experienced human doctors, but those physicians were not allowed access to textbooks or to ask colleagues in the trial, which might have increased their success rate.” 2

That outcome potentially disrupts the entire practice of diagnostic radiology. Robotics in concert with AI could complete the disruption, including treatment.

We chose to overweight AI using two different approaches in equal amounts. BAI

we have owned in our growth model developed with BlackRock since April 2024. BAI

concentrates its holdings by owning as few as 40 securities (presently about 60) and being fairly unconstrained as to sizing (top holding NVDA was 9.98% as of August 15, 2025 vs 8.04% in the S&P 500® Index). WTAI

employs a broader index-based approach that selects companies (60-80) that contribute to the development and deployment of AI innovations. The index is reconstituted twice a year. WTAI

more evenly weights its holdings, with the largest currently less than 4% and most around 2%, thus allowing broader dispersion and more opportunities for small companies to make a material contribution to returns.

Nature's Symphony

Breathtaking colors of our planet

Button

Sources: US Bureau of Economic Analysis (BEA), Macrobond, Apollo Chief Economist

We are maintaining the other equity allocations in the tactical S model. In the slides above, we note the second best performing domestic sector is Financials where we have an overweighting (KBBB) since November and which has yet to see the benefits of deregulation. Nor has deregulation yet to benefit the Energy sector. We still favor the asymmetrical return possibility of our small mid-stream North American pipeline (AMLP) overweighting. If we are wrong, it is too small to hurt much; if right, the impact could be large enough to feel. The overweighting to Germany (EWG) should continue to offset our otherwise underweighting to EAFE index within the ACWI. Lastly, overweighting India (FLIN) in front of Trump’s tariffs requires the conviction that the most populous country in the world will find a way out of the penalty box. Possibly, India finds new markets for the imbalance of goods formerly shipped to the USA; possibly, there’s a rapprochement to Door #3! Either way, this overweight has long term demographics as its strategic underpinning.

We are maintaining the BlackRock model menu of liquid alternatives in our tactical S model.

We are, however, making changes to the income/debt allocations within the tactical S model as well as our neutral N and our Pure Income models. After the election in November, we decided to lengthen duration to move a bit closer to our benchmark, but to do so synthetically by buying instruments (UFIV, MTBA, SPIB) that paid higher current interest and had less sensitivity to overall rate gyrations, while maintaining similar duration and credit quality, thus creating an alternate version of the benchmark. Last week we sold those positions. Generally, if you owned them from the outset, the excess return of those holdings over the benchmark roughly covered most if not all of your investment management fee – with far less volatility.

We shortened duration for the same reasons that we sold FDIS and FSMD in the equity allocation within the tactical model. With the domestic economy slowing (roughly 70% driven by consumer spending), and tariff uncertainty continuing, which, at a minimum, will contribute to near-term inflation, these sales are defensive and tactical.

Should the Federal Reserve ultimately cut overnight interest rates by half a per cent (0.5% or 50 bps) over the next six months as is the current probability, that would move the Fed Funds rate down to a range of 3.75% - 4%. The 5-Year Treasury was trading around 3.75% at the time of those sales. The probability of it going lower over the next six months appears to us small, if at all.

We redeployed those proceeds into a short duration tactical ETF run by PIMCO which we already owned (LDUR) and an ultra short ETF (CLOA) backed by AAA rate assets. In the exchange, we picked up about 10 bps of current yield and shortened duration by roughly 0.5 years: more yield with less interest rate sensitivity. We will likely reverse this trade in the future given another window of opportunity, or more data to support a change.

If you would like more details on any of the changes or model composition, please let your Advisor know. Our investment models and strategies at Advocacy Wealth and Montag & Caldwell are designed to preserve capital as a foundational construction. From there we offer growth, income or a balance of both.

We still hold to the forecast that the three-legged stool of tariffs, the One Big Beautiful Bill (“OBBB”), and deregulation described by U.S. Secretary of the Treasury, Scott Bessent, in March will be moderately accommodative to economic growth and more so to asset appreciation – over time – particularly in the run up to the U.S. midterm elections in 2026. We leave you with this visual that we clipped from a recent Bloomberg media article, which itself is well worth the read in our view:

Nature's Symphony

Breathtaking colors of our planet

Button

- https://www.microsoft.com/en-us/research/publication/sequential-diagnosis-with-language-models/

- “Microsoft AI Unit Unveils Its First Medical Diagnosis Tool.” By Melissa Heikkilä (London) and Stephen Morris (San Francisco). Financial Times Europe, July 1, 2025. (Emphasis added).

- Benchmarks do not charge fees. The benchmark reference here is AGG.

- “Bessent on Tariffs, Deficits and Embracing Trump’s Economic Plan.” By Daniel Flatley and Erik Schatzker. Businessweek, August 11, 2025.

Disclosures

The model portfolio performance returns, where shown or discussed, are hypothetical, for illustration only, and do not represent the performance of a specific actual client account. Performance does not reflect actual trading, nor does it include variable transaction expenses which would further reduce returns. Each Advocacy Wealth model series portfolio invests in securities which have weighted allocations that drive the performance results. The underlying constituent performance results, where shown or discussed, reflect actual historical performance. Returns on the investment in the model portfolio assumes reinvestment of dividends and capital gains. The models performance, where shown or discussed, reflects rebalance of those allocations in response to market conditions, as well as at the initial point in time a change was made to an individual allocation within the model.

Clients’ actual return experiences will vary given the clients’ unique respective needs and circumstances. Clients’ actual returns will be reduced by the investment advisory fees and any other expenses incurred in the management of their portfolios. While Advocacy Wealth maintains an annual standard fee schedule for services as disclosed in its Form ADV Part 2A Brochure, the Firm reserves the right to negotiate fees, so not all clients have the same fee schedule and clients’ net returns experiences will not be uniform.

The S&P 500 Index, and sub-indices reflective of the S&P 500’s various sector components, are unmanaged indices commonly used as benchmarks to measure broad U.S. stock market performance and characteristics and sector-specific performance and characteristics respectively. These are free-float weighted/capitalization-weighted indices. An additional reference is made to the S&P 500 Equal Weight Index (EWI) which is the equal-weight version of the widely used S&P 500. The equal-weight index includes the same constituents as the capitalization weighted S&P 500, but each company in the S&P 500 EWI is allocated a fixed weight - or 0.2% of the index total at each quarterly rebalance. The MSCI ACWI Index is an indicator of global markets, capturing approximately 85% of the global investable equity opportunity set, including stocks predominantly across the large and mid market cap spectrum and across a number of countries, both developed and emerging. The MSCI EAFE Index is a sub-set of the MSCI ACWI Index, focused on developed markets only, including the EU, Australasia, and the Far East, but excluding the U.S. and Canada. Bond data sourced from an independent provider of corporate bond indices with "AGG" typically considered the Bloomberg Barclay's Aggregate Bond Index which is used as a fixed income benchmark. For all indexes, the reinvestment of dividends, interest, and/or other distributions is assumed. Indexes used as benchmarks cannot be directly invested in by you. Index performance is also for illustration only, to provide a relative comparison for the model portfolio. Index performance does not reflect any management fees, transaction costs or expenses.

Past performance does not guarantee future results.

The views expressed represent our assessment of our strategies and the market environment as of the dates represented in the publication and should not be considered investment advice or a recommendation to purchase or sell any specific security or invest in a specific strategy nor used as the sole basis for an investment decision. Views and holdings are subject to change.

There are no guarantees that a strategy will achieve its investment objective. All investments involve risks that you will lose value including the amount of your initial investment. Investments that offer the potential for higher rates of return generally involve greater risk of loss. Clients should review carefully reports or statements produced by us, such as for performance and cash flows, and compare the official custodial records to any such that we provide. Information we provide could vary from custodial statements based on accounting procedures, reporting dates, or valuation methodologies of certain securities.

References to specific securities/ETFs are not intended as recommendations of said securities and carry no implications about past or future performance. Holdings and weights are subject to change. Information about all recommendations made within the past year is available upon request.

Reinvestment transactions that involve selling existing investments may involve transaction and taxation costs associated with the sale of those assets as well as transaction costs associated with the purchase of new investments.

International investing: There are special risks associated with international investing, such as political changes and currency fluctuations. These risks are heightened in emerging markets.

Small/Mid-Capitalization investing: Investments in companies with small or mid-market capitalization ("small/mid-caps") may be subject to special risks given their characteristic narrow markets, limited financial resources, and less liquid stocks, all of which may cause price volatility.

Growth Stock Risk: Growth stock investments, whether directly or through ETFs and mutual funds, may be more sensitive to market movements because their prices tend to reflect investors’ future expectations for earnings growth rather than just current profits.

Sector Risk: To the extent a strategy series has substantial holdings within a particular sector, the risks associated with that sector increase.

Liquidity / Market Risk: The strategy series may not be able to purchase or dispose of investments at favorable times or prices or may have to sell investments at a loss. Additionally, market prices of investments held by strategy series may fall rapidly or unpredictably due to a variety of factors, including changing economic, political, or market conditions, or other factors including war, natural disasters, or public health issues, or in response to events that affect particular industries or companies.

High-Yield investing: Investments in high yielding debt securities are generally subject to greater market fluctuations and risk of loss of income and principal, than are investments in lower yielding debt securities.

Inflation Protected Bond investing: Interest rate increases can cause the price of a debt security to decrease. Increases in real interest rates can cause the price of inflation-protected debt securities to decrease. Interest payments on inflation-protected debt securities can be unpredictable.

Interest Rate Risk: This risk refers to the risk that bond prices decline as interest rates rise. Interest rates and bond prices tend to move in opposite directions. Long-term bonds tend to be more sensitive to interest rate changes and therefore may be more volatile.

Earnings Growth – A fundamental factor about a company that can assist investors evaluate the health of the business, how fast the company’s profits are growing over a particular time period, as well as the company’s potential stock market performance. EPS Growth or Earnings per Share Growth then evaluates the company’s profitability on a per stock share basis. An Earnings Surprise is when there is a disconnect between the company’s disclosure of reported earnings pers hare and what the markets and analysts anticipated. Earning surprises can be positive or negative events influencing potential stock price movement.